A brand-new program was buried inside President Trump’s tax reform legislation.

It’s one of the most critical parts of the tax law, yet largely went unnoticed… but not by team Sovereign Man.

The program is called Opportunity Zones.

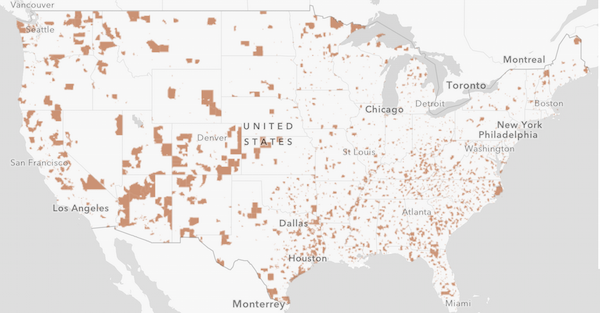

For those of you sitting on unrealized capital gains – think stocks, real estate, art, and even cryptos – you’re in for a treat. Through the program, you can sell your appreciated assets, defer capital gains tax, and invest the proceeds into one of 9,000 designated distressed communities across America called Opportunity Zones.

Most of Detroit and Baltimore is an Opportunity Zone… and even parts of Manhattan.

Your investment in real estate, an existing business, a new business, etc. located in an Opportunity Zone can grow completely tax-free.

And this program works not only for Americans. Foreigners with US assets and capital gains tax obligations to the IRS can benefit, too.

The program is still very new, but we believe it will be a huge success.

In today’s Sovereign Man: Confidential Alert, we discuss the basics of Opportunity Zones, qualifying Opportunity Zone investments and exactly how to take advantage of this program.

Click here to access your comprehensive report. (In the report you can also access the interactive calculator where you can simulate your own Opportunity Zone investment scenario and witness the tax savings it can offer.)

It’s one of the most critical parts of the tax law, yet largely went unnoticed… but not by team Sovereign Man.

The program is called Opportunity Zones.

For those of you sitting on unrealized capital gains – think stocks, real estate, art, and even cryptos – you’re in for a treat. Through the program, you can sell your appreciated assets, defer capital gains tax, and invest the proceeds into one of 9,000 designated distressed communities across America called Opportunity Zones.

Most of Detroit and Baltimore is an Opportunity Zone… and even parts of Manhattan.

Your investment in real estate, an existing business, a new business, etc. located in an Opportunity Zone can grow completely tax-free.

And this program works not only for Americans. Foreigners with US assets and capital gains tax obligations to the IRS can benefit, too.

The program is still very new, but we believe it will be a huge success.

In today’s Sovereign Man: Confidential Alert, we discuss the basics of Opportunity Zones, qualifying Opportunity Zone investments and exactly how to take advantage of this program.

Click here to access your comprehensive report. (In the report you can also access the interactive calculator where you can simulate your own Opportunity Zone investment scenario and witness the tax savings it can offer.)

A brand-new program was buried inside President Trump’s tax reform legislation. It’s one of the most critical parts of the tax law, yet largely went unnoticed… but not by team Sovereign Man. The program is called Opportunity Zones. For those of you sitting on unrealized capital gains – think stocks, real estate, art, and even…

- Members Only Content -

You need to be a member of Sovereign Confidential to access this content.

If you are a member already, please login below.